What is Swing Trading?

Importance of volatility and liquidity in swing trading

&

How to pick stocks for swing trading

What is swing trading?

Swing trading is a trading technique that aims to capture short- to medium-term gains in a stock over a period of a few days to several weeks, and relies heavily on technical analysis when developing trading strategies. Rather than companies’ fundamentals and intrinsic value, swing traders use trends and patterns when taking their trading decisions.

Swing trading enables better control and flexibility to be able to time markets and take advantage of either price direction (either an increase or decrease) but it also brings some risks because unexpected events or news may cause the price of a given stock change in the unexpected direction.

Importance of volatility and liquidity in swing trading

The first key to a successful swing trading is picking the right stocks which are often volatile and have a relatively high level of liquidity. Volatility is likely the most important ingredient to swing trading, which creates buy/sell opportunities with the help of price movements. More volatile stocks create more opportunities to make profit in swing trading. Higher liquidity makes it easier to sell stocks when you need it.

How to pick stocks for swing trading

Swing trading relies heavily on technical analysis. Simple Moving Averages (SMAs) are widely used to determine support and resistance levels, as well as bullish and bearish patterns.

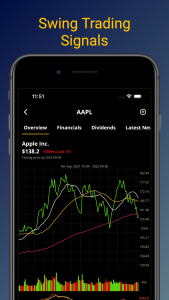

But how would you scan thousands of stocks each day and detect the ones with biggest upside potential in the short term? This is the main reason why we have developed Share Predictions mobile app.

Share Predictions provide AI powered predictions for the short term price movement of common stocks. Each prediction indicates the likelihood of a price increase (or decrease) in the short term, and predictions are renewed on a daily basis as we collect more data from markets.

If a prediction is above 50%, it indicates a price increase expectation for the corresponding common stock in the short term (roughly 1 month); otherwise, a price decrease is expected. As a prediction gets closer to 100% (or 0%), it indicates a stronger algorithmic expectation for a price increase (or decrease) within the validity period of the prediction.

Short listed common stocks for swing trading

While Share Predictions provide a unique prediction for each of thousands of common stocks, it also offers a short listed stocks that include such stocks with biggest upside potential in the short term.

There is one short list for penny stocks, and another one for the rest of the common stocks. These stocks, particularly the penny stocks, happen to be a more volatile than others but it is likely not the only reason why they end up in the short listed ones. It may be so that a particular stock has had a significant price reduction lately and our models may be expecting a certain price correction, or there is maybe an ongoing positive trend and our models may be expecting the continuation of the trend in the short term.

For each prediction in the short listed stocks, we also share a reference buy target, sell target, and stop loss value so that traders can get a clearer understanding of the scope of each trading opportunity.

These predictions are indicative and aim to provide a short list of stocks that short term traders can focus on and perform a secondary technical analysis to be able to give the best possible trading decision. To enable this, Share Predictions provides premium analysis tools. You can analyze each stock from multiple angles by looking at charts where you can follow the trends of price, simple moving averages, Bollinger Band, MACD, Signal Line, and RSI. Moreover, you get access to additional technical indicators (i.e. volatility figures of stocks), company financials (taken directly from both quarterly and annual financial reports), dividend history, and even latest stock specific market news from well known financial media sources. AI predictions, combined with a secondary technical analysis, aim to give you the best possible opportunities in your trading decisions.