What is Trend Trading?

How to pick stocks for trend trading

&

Trend trading case study

What is trend trading

The overall price direction of a given stock defines its trend. An uptrend is identified when the overall price direction keeps making higher highs and also higher lows in the time line. Similarly, a downtrend is identified when the overall price direction keeps making lower highs and lower lows. Neither an uptrend nor a downtrend continues forever. Trend trading is a commonly used trading technique using which traders try to enter into a long position in the occurrence of an uptrend and a short position when a downtrend starts. Trend trading is used by both short term and long term traders.

Technical indicators are commonly used when identifying an uptrend and downtrend in the markets. Both short term and long term traders can use trend trading, and what primarily differs between them is the type of indicators that they follow when identifying short term and long term trends.

For any trend trader, developing a game plan involves defining when to buy and when to sell a given stock. Developing such a game plan and implementing it in a disciplined way help traders to execute their trading decisions in a non-emotional way.

Case example

It is possible to develop a game plan for trend trading in different ways. In this case study, we will focus on short term trading and be using 2 types of technical indicators. For the sake of this case study, we will be focusing on 500 stocks with highest market capitalization from US stock markets.

Trend trading game plan

To enter into a long position, our methodology will be following a stock during 3 days:

– Day 1: The closing price of the stock shall be below its 20 days moving average.

– Day 2: The closing price of the stock shall be above its 20 days moving average. This means that the closing price of the stock crosses above its 20 days moving average.

– Day 3:

– The closing price of the stock shall remain above its 20 days moving average. This will mean that the closing price of the stock remained above its 20 days moving average on 2 consecutive days after crossing it.

– Histogram is greater than zero. Histogram is calculated by subtracting Signal Line value from MACD. A positive Histogram value signifies a recent increase in upward momentum. By adding this additional control, we will aim to decrease the number of false positive buy signals.

– Day 4: The stock that meet all the listed criteria above will be purchased on this day. And the open price of the stock on this day will be taken as the reference buy price when evaluating the performance of this approach.

Defining when to enter into a long position is just one side of the problem. We also need to define our exit strategy, that will tell us when to enter into a short position.

– After the end of each market day, the Histogram value will be updated based on the latest trading day that ended. If the Histogram goes below zero, a sell signal will be triggered for the next trading day. When deciding when to exit from the long position, as you will recognize, we are not looking at the 20 days moving average as we did when entering into the long position. This is chosen so because Histogram tends to signal a trend reversal (from uptrend to downtrend) a bit earlier than moving average figures. For the sake of this case study, the sell price will be taken as the opening price of the stock on the next market day.

Summary of backtesting results

The study is backtested on 500 stocks with highest market capitalization for almost 6 years of data. Defined criteria above triggered 14000 buy-sell signals. For the case of this study, it is assumed that the initial budget was $100, and $10 is invested on each stock that triggered the buy signal (no matter the changing total budget size over the time). At the end of all buy-sell executions, the initial $100 budget reached $1789 at the end of 6 years, returning a 1689% profit in total.

This is a rather aggressive method because it aims to capture profits in short term and aims to catch a potential uptrend as early as possible. As a result, it can be expected to see some false positive (buy) signals. The following chart shows average profit/loss figures vs the average number of days a stock is held after the purchase.

As seen in the chart above, as the number of days increases after the purchase of the stock, the achieved profit increases as well. Up until 15 days, the strategy creates more losses than profits and the maximum average loss stays at the levels of -5%. Starting from 16 stock holding days after the purchase, profits start to dominate. But this chart does not show the actual number of trades that ended with profit and loss; so let us have a look at the next one to get an idea about it.

As seen in the above chart, 55% of the buy signals ended with a loss while 45% of the buy signals returned profit. Even though the number of losses is higher, the overall result is still a profit due to the fact that achieved profit figures are higher than that of losses.

Waiting for a longer time for the confirmation of an uptrend before going into a long position can be an option to decrease the number of losses but our tests show that such a more conservative approach causes the overall profit go down in the long run.

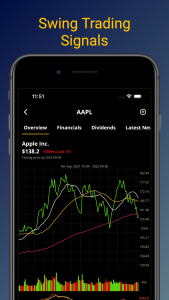

Share Predictions mobile app provides tools to develop your own trend trading strategies. It also runs an example portfolio that is created based on algorithmic buy, hold and sell signals. You can follow the results of trend trading portfolio study in our application. Share Predictions is available in both Apple App Store and Google Play Store.